So it covers trade to the confidential boardroom knowledge, since the Collins circumstances demonstrated. An administrator otherwise staff basically have an obligation on the business and its shareholders to keep particular suggestions private. Whenever one faith are busted, whether by the change or tipping, they produces insider exchange liability. Attorneys to your Southern area Area of brand new York ranging from 2009 and you will 2017 offering him legislation more criminal activities affecting Wall surface Path and he aggressively ran once insider people, successful 84 of your own 85 insider trading times the guy prosecuted.

Immediate-connect – Conserve occasions away from research go out

Investing social enterprises always suggests an amount career for all buyers. Yet not, getting insider advice offers a trader a bonus over all other participant. Leverage insider advice to tell one’s trading and investing behavior is named insider trading. This informative guide will explain the fundamentals away from insider change, just how it affects the market, as well as how it can be utilized for your convenience.

Once a great 2004 demo, Stewart are charged with less crimes from congestion of a great proceeding, conspiracy, and to make not the case statements to help you government investigators. This type of filings will be utilized through the SEC’s Digital Research Get together, Research, and you can Retrieval system and with the SEC Insider Investments Datasets, where investors can also be seek insider exchange account by organization label otherwise ticker symbol. The brand new Bonds Replace Operate out of 1934 is actually the original laws and regulations in the the new U.S. so you can exclude insider trading one to aims so you can mine nonpublic, matter suggestions to own money.

Learn just what insider trade are, why it is unlawful, and you may exactly what the punishment are.

- Researchers have pointed out that settlement when it comes to insider trading are “cheap” for long-label investors because it does not are from business profits (Hu and you will Noe 1997).

- If you bought shares away from a buddies after discovering throughout the an enthusiastic income phone call so it overcome criterion, that’s the better and you may a good.

- If you see the organization’s email address details are for example good for the most recent quarter and purchase offers before earnings had been announced, you’d get in solution away from insider exchange regulations and you may will be at the mercy of fines and you will you are able to prison date.

- Insider trade ‘s the act of shopping for and you will attempting to sell stock, or other monetary products, by the individuals who have use of information who’s not started generated in public places available.

One particular example would be should your tipper gotten people individual gain benefit from the disclosure, and thus breaching their obligations out of support to the organization. Inside Dirks, the brand new “tippee” had received private advice from an insider, a former worker away from a family. Why the newest insider got expose every piece of immediate-connect information on the tippee, as well as the reasoning the new tippee had revealed everything to help you third events, were to blow the fresh whistle to your scam at the organization. Considering the tippee’s efforts the brand new con is actually exposed and also the company went to the bankruptcy. The newest court governed the tippee cannot were aiding and you may abetting a securities law solution committed from the insider as the no ties laws solution got enough time from the insider.

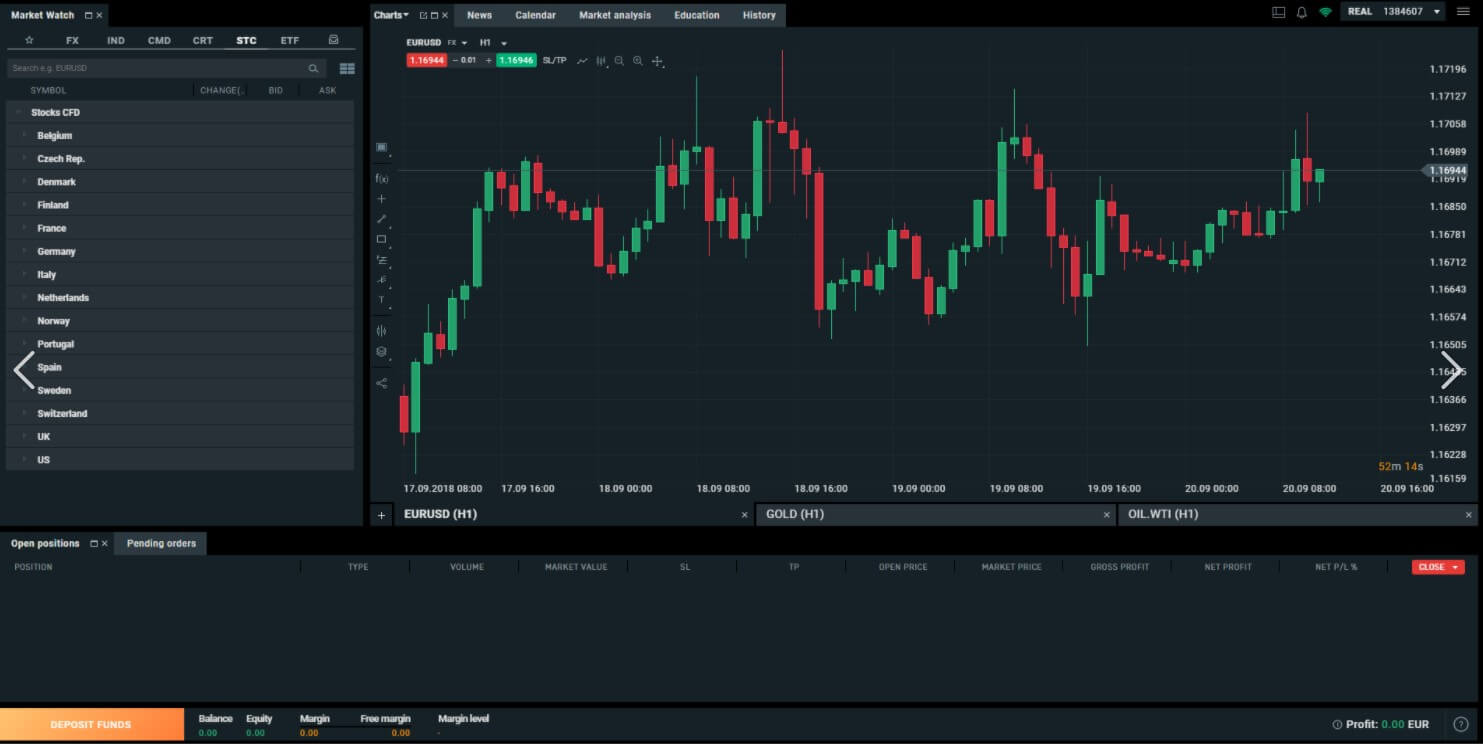

Inside the 2025, numerous technology indications have proven including active in terms of cross-confirming insider trading indicators. Such indicators get into groups for example frequency-dependent, momentum-founded, and you may volatility-founded actions. Picking up in these indicators very early can be quite lucrative, however it is really tough, since the places is actually loud and you can influenced by thousands from items.

Found Indicators for the SEC-confirmed Insider Inventory Positions

The new SEC so-called one Stewart committed insider trade whenever she sold 4,100 shares from biopharmaceutical organization ImClone Possibilities Inc. someday until the You.S. Fda would not comment the organization’s application for its cancer medicine Erbitux. When reports of your declined application turned into personal, the business’s shares fell because of the 16%. Supreme Courtroom followed the fresh misappropriation idea of insider trade in the Joined Claims v. O’Hagan,79 521 U.S. 642, 655 (1997). O’Hagan try somebody within the a law firm representing Grand Urban although it is actually given a tender offer to possess Pillsbury Company. O’Hagan made use of that it to the guidance by buying label choices to your Pillsbury stock, and so realizing winnings of over $cuatro.3 million.

But if you bought shares of the identical business since your brother-in-laws, who simply often is the business’s head economic officer, tipped your from prior to the money discharge that business got an exceptional one-fourth, that would be unlawful insider trading. The fresh SEC continues to improve the method of insider exchange controls as a result of previous amendments so you can Signal 10b5-step one and you may improved scrutiny away from methods including trace trade. For business insiders, the answer to navigating which, Mostafa said, has been rigid adherence in order to revelation requirements, careful considered from positions, and you can a comprehensive knowledge of exactly what constitutes topic, nonpublic guidance. Because the we now have viewed, it is not merely team professionals who can be convicted of insider exchange.

Although not, it wasn’t until the 1960s your SEC started to a lot more aggressively go after insider exchange times less than Laws 10b-5, and therefore prohibits fraud when purchasing or selling ties. “Insider trading” is nearly always meant because the illegal operate from improperly exploiting one’s insider part to have cash as a result of bonds exchange. Meanwhile, sentences such as “insider deals” or even “exchange by insiders” reference the complete group of ties transactions because of the those people within this an excellent corporation, not merely what is actually unlawful. Now, insider screener is utilized from the a huge number of investors to get into insider exchange investigation. The new SEC spends the fresh Dirks Attempt to choose if a keen insider provided a rule illegally; the test claims when an excellent tipster breaches its believe having the organization and you can understands that this is a breach, that person is likely to possess insider change.

“When you’re a specialist for the solar and you may analysis due diligence, which allows you to definitely earn some effective trades, there’s nothing incorrect using this type of.” Courtroom insider trade happens often, such as when a president buys back offers of their organization otherwise whenever almost every other group purchase inventory in the company where they work. Have a tendency to, a chief executive officer to buy offers is also dictate the cost way of the stock they’ve. Insiders are legitimately permitted to purchase and sell shares of your business and one subsidiaries one to utilize her or him. But not, such transactions should be properly entered to the Ties and you can Replace Percentage (SEC) and they are finished with get better filings.

You’ll find information on these insider change to your the brand new SEC’s EDGAR database. Enforcement out of insider trading laws may differ widely out of country to country, however the majority of jurisdictions today outlaw the brand new behavior, at the least in principle. And when properly disclosed, it can be a benefit so you can merchandising and you can organization people as the a complement so you can simple otherwise technical investigation. The primary concept of insider exchange stems from the phrase change, and therefore constitutes a task. She understands that the firm is just about to and get another organization and you may offers you to information with friends and family earlier gets public record information.

Issue info is something that you will significantly apply to an investor’s trade decisions. These include experience in private company income reports, a primary buy, otherwise regulating change. Non-public function everything wasn’t given to the newest public as a result of Defense and you can Replace Fee (SEC) filings, news reports, or any other societal stores. Insider trading ‘s the habit of selling ties away from a community company when you are possessing thing information about the organization you to isn’t known to the new using societal. As well, the supporters say that insider trading ‘s the closest matter to a “victimless” crime inside the modern finance.

Bankrate.com is actually a different, advertising-offered author and you can analysis solution. Our company is compensated in exchange for placement of paid products and functions, otherwise by you clicking on particular backlinks published on the our very own site. Therefore, so it settlement could possibly get feeling how, where and in just what buy issues come within this checklist kinds, but in which prohibited by-law for the home loan, house collateral or other home financial loans. Other variables, including our very own proprietary webpages legislation and you may if a product exists in your area otherwise at the thinking-picked credit history variety, can also impact how and you may in which things show up on this site.

They ought to know precisely what’s going on inside business and it is constantly promising to see her or him put their funds in which the mouth area is actually.” — Jim Slater, a british accountant and you may trader, in the Zulu Principle. Friedman considered that insider investors shouldn’t be necessary to in public places reveal its change while the pressure from the trade in itself stands for information to the market. However, the new economic government discover which signs to search for inside the insider change or other manipulative tips. In one of the basic instances of insider trade pursuing the United states are molded, William Duer, assistant on the Panel of Treasury, utilized suggestions the guy gained away from their regulators status to support their orders of securities. Duer’s rampant conjecture composed a bubble, and therefore culminated from the Worry away from 1792. The fresh also provides that appear on this website come from firms that make up united states.

AI, Tariffs, Nuclear Strength: You to definitely Undervalued Inventory Links All the Dots (Earlier Explodes!)

After learning individually your demonstration overall performance was confident, the guy unofficially bought offers of the drugmaker. In the event the business established the positive contributes to November 2020, the new stock instantly jumped more 3 hundred%, and you can Catenacci sold their offers to have an excellent $134,100000 cash. In some instances, all the details useful for a swap will get well known. The main point is that if a single were to discover anything days otherwise days before the general public, they could get ready a swap to increase her gain. Insider change is nothing the fresh—it has been going on so long as inventory segments have been popular.